A recovery for the shrimp market?

‘Mixed recovery’: Rabobank forecasts modest growth for shrimp industry in 2024, but global market challenges hinder bounce-back efforts.

Rabobank anticipates marginal improvements in key shrimp markets like the United States, EU, Japan and South Korea, but challenges to recovery remain.

As the global farmed shrimp industry navigates the complexities of the global market landscape, a new Rabobank report suggests a glimmer of improvement compared to the previous year, particularly in key markets like the United States, European Union (EU), Japan and South Korea.

However, it’s likely the road to recovery will remain sluggish. Retail dynamics, particularly in the United States, are impacting pricing and hindering a full rebound. While some markets have seen the worst, uncertainties remain, especially regarding sustained growth in Europe and the economic stability of China.

Despite these challenges, modest positive growth is projected for the year, tempered by ongoing low prices and supply dynamics. Following a presentation at the North American Seafood Forum (NASF), Gorjan Nikolik, senior analyst at Rabobank, provided Advocate readers a snapshot of what the shrimp sector can expect for 2024.

A new Rabobank report forecasts modest growth for the shrimp industry in 2024, but ongoing global market challenges hinder a full recovery. Photo by Seabina Group.

Global shrimp markets look ‘only slightly better’ than 2023 but ‘worst is over’

The global markets show only marginal improvements in 2024 compared to the previous year. Current data indicates that the United States, EU, Japan and South Korea are all hinting at a resurgence in demand growth, but from a low point with gradual recovery. The retail sector has played a role in the slow rebound.

“Since 2020, shrimp has become cheaper in the U.S., and it’s now 53 percent of what it once was,” said Nikolik. “But retailers haven’t passed on the full decline of the wholesale price to the customer, which is partly preventing a recovery.”

Nikolik said that “the worst point has passed” when looking at the U.S. market, and even though it’s at a low level right now, the demand is trending “flat and upwards.” Whereas the EU and UK markets have seen more of a “mixed recovery,” Nikolik said “the worst is over” in terms of demand decline.

“Questions remain about whether there is still growth left in Europe,” said Nikolik. “Looking at U.K. data, we see that the drop of wholesale prices is not reflected in retail prices.”

The U.K. data illuminates a particularly interesting trend: Despite the decline of wholesale prices, the price of shrimp actually increased in 2023, falling within the range of other products, such as beef steak and fresh salmon fillets. This can partly be attributed to the supply shortage of wild-caught shrimp, but it’s also rooted in retail pricing strategies.

“Rather than discounting shrimp and promoting it, some retailers look at the relative price of different items and keep those in line with each other,” said Nikolik. “In earlier days, such as 2020 to 2022, some retailers had negative shrimp margins because prices had been higher. And now they’re very healthy shrimp margins. So, they’re compensating for what they had lost in the past, which doesn’t help with creating demand.”

In Asia, Japan and South Korea appear to have returned to demand growth by the end of 2023, as evidenced by a decrease of 7.9 percent in value and 10.1 percent in volume for their shrimp imports up to December 2023.

“Overall, the three big shrimp buyers from the developed world all behaved similarly, and for all of them, the worst is over,” said Nikolik.

China continues to be a wild card

China, traditionally a major market driver, has exhibited economic shakiness, raising questions about how high inventory levels might affect the global demand for imported shrimp.

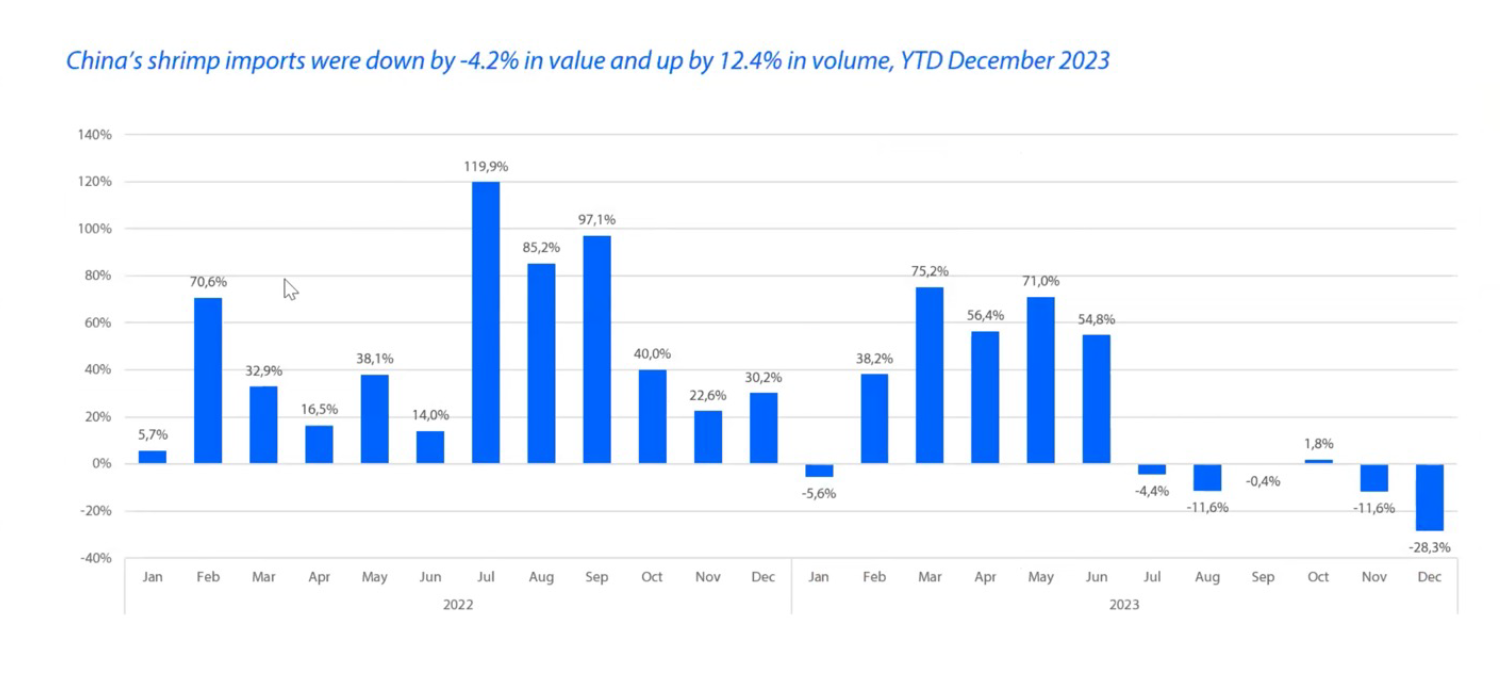

“In 2022, you see these huge import increases,” said Nikolik. “There were very low imports in 2021, because the Chinese found traces of COVID-19 on the outside of the frozen shrimp packaging from Ecuador, and Ecuadoran imports went to almost zero.”

The 75.2 percent jump in March 2023 related to the industry gearing up for the post-COVID opening, which led Chinese importers to overbuy and end up with a large inventory. In the year up to December 2023, China’s shrimp imports were down in value by 4.2 percent, but up by 12.4 percent in terms of volume.

In the year up to December 2023, China’s shrimp imports were down in value by 4.2 percent, but up by 12.4 percent in terms of volume.

Overall, it’s projected that China, at least in H1 2024, will be less of a market driver, with uncertainty about whether import demand will come back.

Supply not expected to contract in 2024, despite low prices

Supply levels are projected to remain steady throughout 2024, despite the prevailing low prices. Ecuador’s growth rate is notably decelerating, albeit from a relatively larger base, while India and Indonesia are poised to capitalize if there’s demand from the United States.

“For next year, India will be somewhat positive if the U.S. is positive and there are no anti-dumping issues,” said Nikolik. “India will bear the biggest brunt given that the country has the highest exposure to the United States as an exporter.”

Nikolik predicts that Ecuador will go from a high growth rate – stemming from significant investments in feed, automatic feeders and genetics in earlier years – to a positive but low supply growth of roughly 4 or 6 percent in 2024.

“Due to the numerous external and domestic factors, we now see higher costs,” said Nikolik. “The huge growth of Ecuador is over and now we expect a more normalized single-digit growth rate.”

However, Ecuador’s investments in value-added processing will help mitigate the impact of low shrimp prices.

“Ecuador is going from 100,000 tons to over 350,000 tons of value-added products,” said Nikolik. “This helps them because these value-added products have a much higher price, and they can make more money on the processing, and especially the larger corporate companies.”

Overall, while some regions show promising signs, caution lingers amid persistent challenges and uncertainties in the global market landscape. In the absence of a new disease, it’s predicted that 7 million metric tons (MT) of supply could be reached by 2030.

“Putting it all together, Asian supply was probably down 5 to 6 percent in 2023, and overall, the world was down about 1 percent because Ecuador has taken market share,” said Nikolik. “For our view for 2024, I think it’s going to be a low but positive growth number.”

Low prices will persist

Changes in the shrimp market have resulted in more efficient producers replacing less efficient ones, altering the supply curve. Although there’s hope for a quicker global demand recovery, the market is still likely to face challenges in achieving significant price increases due to the continued growth in supply. While costs, especially for feed, might get better in 2024, it’s likely to stay elevated compared to pre-pandemic.

Uncertainty looms over China’s net shrimp imports, with its import demand possibly staying stagnant. In that case, Ecuador might see slight growth, particularly in Asian markets like China. However, a negative scenario could unfold if China ramps up internal production due to technological advancements.

Additionally, U.S. demand might suffer from higher tariffs and concerns over labor abuse allegations. This could lead to a weakened U.S. import demand and further exacerbate the low-price situation. In such a scenario, a supply contraction in the industry, especially in Asia, could happen.

“The new things that are coming up now are potential threats for demand recovery in the U.S. due to anti-dumping tariffs and countervailing duties and labor conditions,” said Nikolik. “If all of that ends up increasing the cost of shrimp in the U.S. and decreasing demand, that’s a problem because we were hoping that the U.S. would come in as a growth factor.”

Source: www.globalseafood.org

Other news

- Shrimp market: Fear of inflation and declining demand 22/10/2022

- Summer demand remains strong in the United States of America and Europe 08/11/2021

- Global supply chains are being battered by fresh COVID surges 18/08/2021

- Animal Health and Welfare in Aquaculture 17/08/2021

- Pangasius Imports Outpacing Tilapia 10/08/2021

- Growth in India's Shrimp Production and Exports 08/08/2021

- Decline in shrimp exports to China makes shrimps cheaper in India for domestic market 03/08/2021

- Rabobank sees plenty of positives for both shrimp and salmon sectors 29/07/2021

- Asia’s Shrimp Connoisseurs: Japan, Taiwan And South Korea 02/07/2021

- Latest Vannamei in India update 01/07/2021